Fitch Affirms 'AAAF/S1' County Investment Pool Rating

08/08/24

25th Year in a Row Top Rating Earned by San Diego County

SAN DIEGO, CA, August 8, 2024 – San Diego County Treasurer-Tax Collector Dan McAllister announced that Fitch Ratings reaffirmed the ‘AAAf/S1’ rating on the San Diego County Investment Pool.

This marks the 25th year in a row the County’s investment pool has received a AAA rating, which is the highest rating category. The ‘AAAf’ rating reflects the investment portfolio’s vulnerability to losses and is based on the actual and expected credit quality of the portfolio’s investments. The ‘S1’ Fund Market Risk Sensitivity Rating reflects the low sensitivity of the portfolio to market risk.

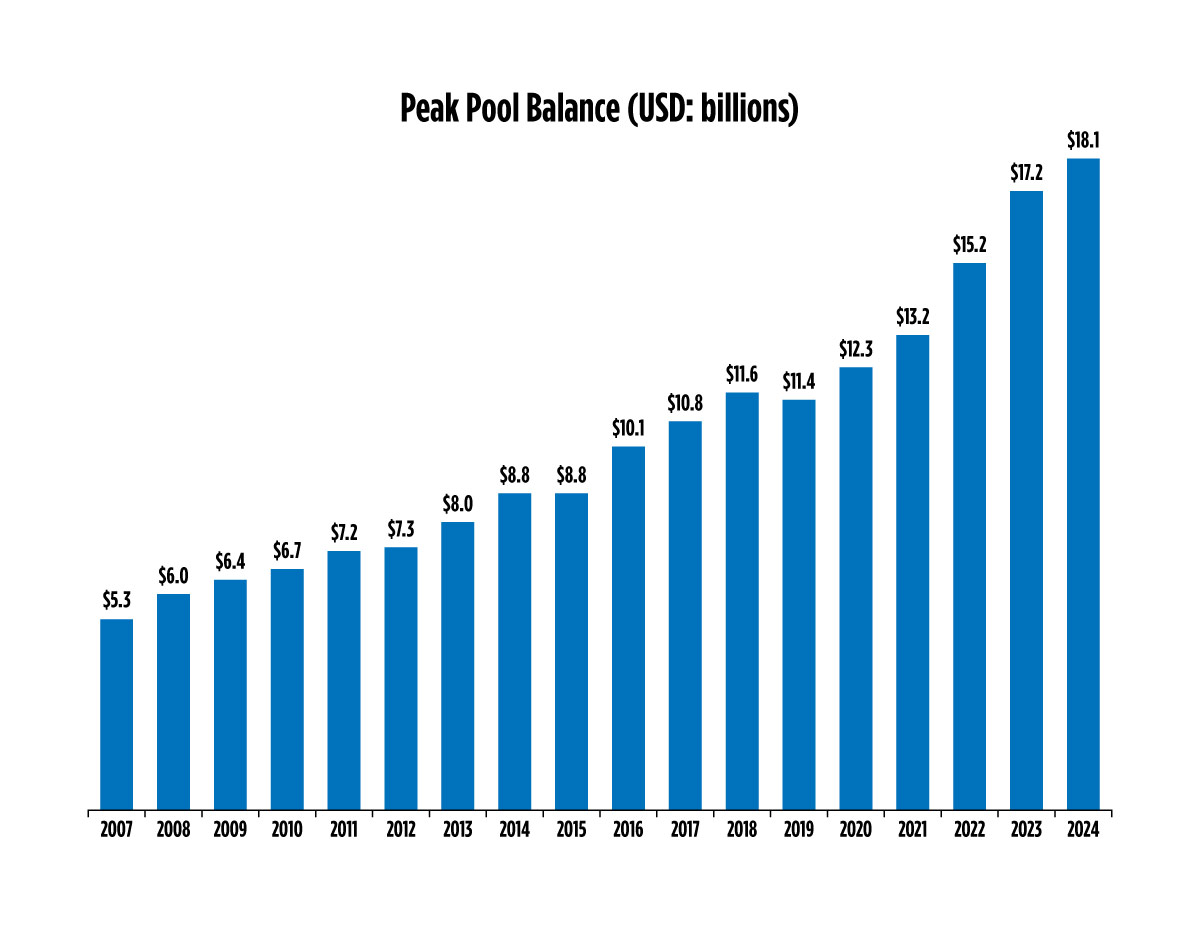

“Our investment pool reached $18.1 billion in public funds in April, thanks to the diligent management by our investment team,” said McAllister. “They value three principles: safeguarding the principal of the invested funds, meeting the liquidity needs of our pool participants, and achieving an investment return within the parameters of prudent risk management.”

The Treasurer-Tax Collector’s team invests the funds in high quality fixed income securities on behalf of the pool’s participants, who use the money for the operational and capital needs of their agencies.

"The Fitch rating process is an important measure of our county's fiscal strength and future,” said Supervisor Nora Vargas, Chair of the San Diego County Board of Supervisors. “This rating is a testament to our commitment to responsible financial management, ensuring that the public's funds are handled with care and integrity.”

Currently, over 200 public agencies in the San Diego region invest in the pool, including all 42 public school districts, five community college districts, the San Diego Regional Airport Authority, SANDAG, MTS, and other public agencies such as cities, fire, and water districts.

In addition to the team of full-time investment professionals in the Treasury, a nine-member oversight committee comprised of county, school, and public agency officials and five public members reviews the county’s investment policy statement annually.

The following chart shows the investment pool’s balance since 2007.