Avoid Penalties! Deadline to Pay Today!

04/10/25

Taxpayers Urged to Pay Online at SDTTC.COM

SAN DIEGO, CA – San Diego County Treasurer-Tax Collector Dan McAllister is reminding San Diego property owners that today is the deadline to pay the second installment of their property taxes before they are considered delinquent and incur additional charges.

“If you haven’t yet paid your property taxes, you must do so today to avoid penalties,” said McAllister. “To avoid the 10% penalty plus $10 fee we encourage property owners to go online and pay their second installment right away.”

Property tax payments are expected to generate $9.1 billion dollars for the region, a new record. All 1,018,103 secured tax bills are available now at sdttc.com to view and pay. Property owners can pay online free using an e-check. Taxpayers will get an immediate, emailed receipt for payment confirmation if they use the online payment system at sdttc.com.

The first property tax installment was due on November 1, 2024. The second installment was due February 1, 2025, and becomes delinquent after April 10, 2025.

Property owners can find their tax bill information online or call the Treasurer-Tax Collector’s Office toll free at 877-829-4732.

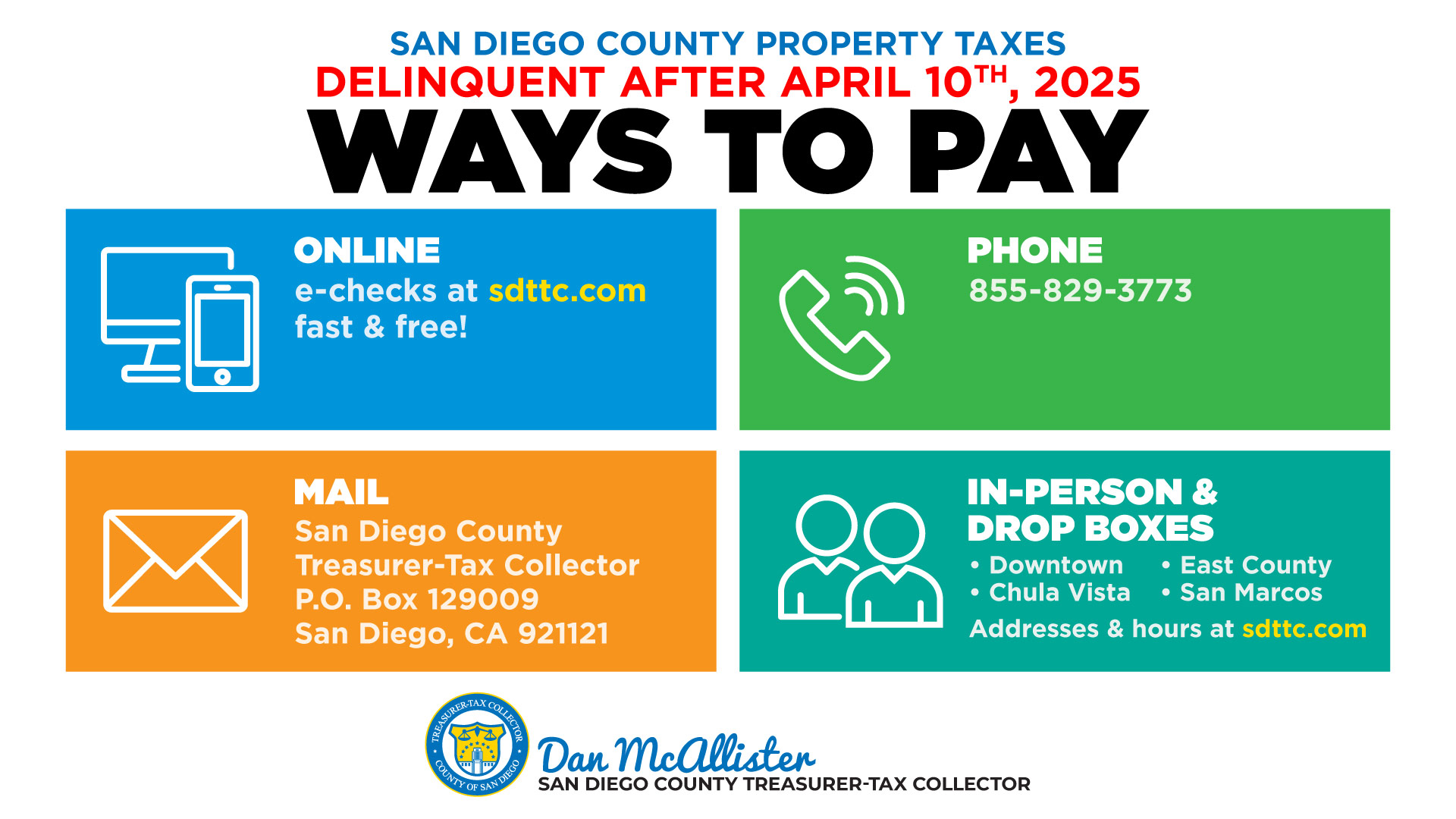

TAXES DELINQUENT AFTER APRIL 10! PROPERTY TAX PAYMENT OPTIONS:

- ONLINE – Pay with an e-check at sdttc.com.

- PHONE – Call 855-829-3773 to pay a Secured Bill with an e-check or credit card. A 2.19% convenience fee is applied to credit card payments by the payment processor for transaction costs.

- MAIL – P.O. Box 129009, San Diego, CA 92112

-

BRANCHES & DROP BOXES – Check sdttc.com for hours of

operation.

- Downtown Branch, San Diego County Administration Center (Cash Accepted Here): 1600 Pacific Highway, Room 162, San Diego, CA 92101

- East County Branch: 10144 Mission Gorge Road, Santee, CA 92071

- Chula Vista Branch: 590 Third Ave, Chula Vista, CA 91910

- San Marcos Branch: 141 East Carmel Street, San Marcos, CA 92078

Click here to see how taxes are allocated.